By Annett Koegler, Co-founder at Santex

Why we finish movies we aren’t enjoying, stay in bad relationships, hold on to investments that are underperforming.

When you lose something permanently, it hurts.

In order to avoid this negative feeling we do irrational things. You probably have been to a restaurant and ordered something terrible, but you ate it anyway. You didn’t want to waste the money, so you suffered through it. Or you went to a concert even though you did not feel like or something else was more interesting. You still went in order to justify spending money you knew you could never get back. If you can identify with any of these stories, you fell victim to the sunk cost fallacy, also known as the Concorde fallacy.

The Concorde was a joint development program of the British and French governments that continued when the economic benefits of the project were no longer possible. It was designed to be a supersonic passenger aircraft but its lasting legacy resides mostly in game theory, where it has been adopted as a description of irrational behavior.

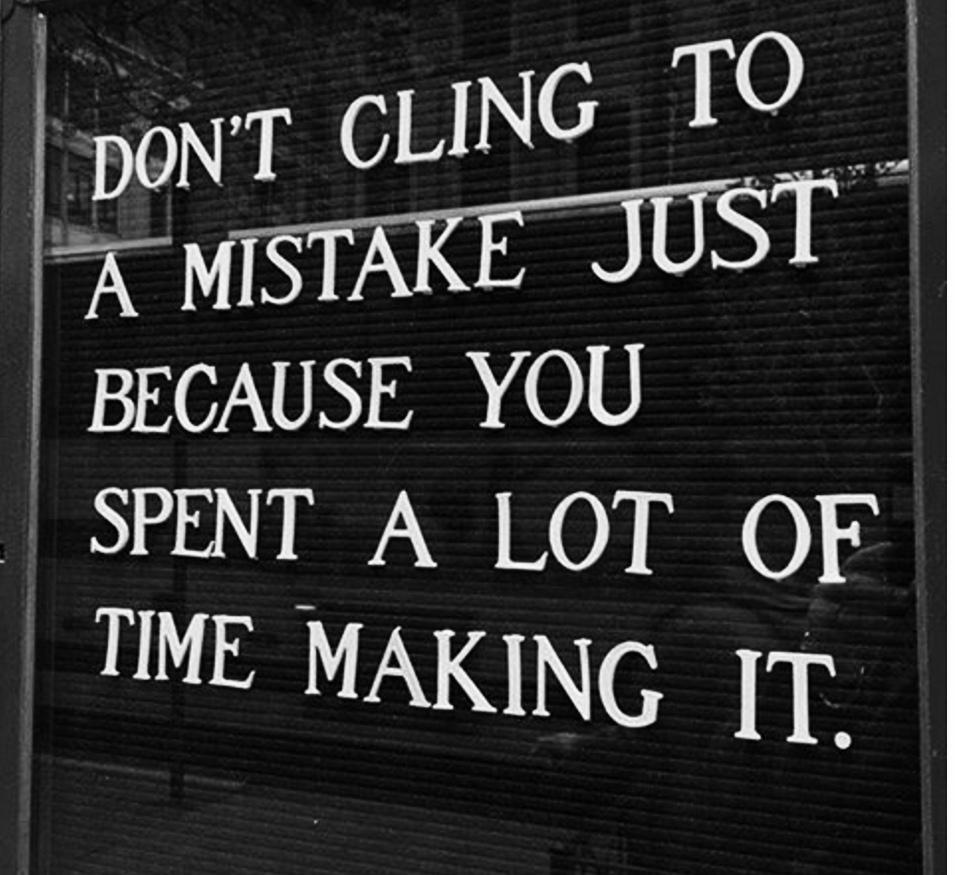

The fallacy is known for valuing a project based on how much you’ve invested, its “sunk costs”, rather than on its real present value.

If its value is negative and future costs outweigh future benefits, you should abandon it, regardless of how much you’ve already invested. No decision can influence what you’ve already spent, and only future costs and benefits should be allowed to affect decisions.

It is difficult to overcome our own irrationality, we take general good rules and misapply them. We tend think of money we’ve already lost as being ‘still on the table,’ and if only we increase the commitment, we could get it back. To leave would force us to admit our mistake and deal with the cost.

“Pride goeth before destruction” – Proverbs 16:18

Why?

One explanation is the reward that is placed to fall pray of the fallacy by our institutions. In politics for example we do not pay the price for being wrong individually, since not one person decides the election. We usually make voting decisions that are biased and ill-informed. Unlike politics, the market does often punish those who fall for the sunken cost fallacy. Companies are rewarded for overcoming people’s biases, while vote-seeking politicians are rewarded for gratifying them.

Another explanation is loss aversion. From a psychological point most people prefer to keep their losses low, even if it means enduring a bad experience.

We humans are unique. We like to hang on to investments that we know are going to fail, in an effort to recuperate the money already invested.

We stay in careers that make us unhappy, since we are already with the company for 10 years and it has to get better as some point.

We don’t realize that the time and money you’ve sunk is irrelevant, because it is a backward looking decisions.

The exact reasons why people pay attention to sunk costs are not clear, but the smartest choice is most likely to walk away and cut your losses, something most are not will to do. Our decisions should be for the future and not for justifying the past.

“After a crisis we tell ourselves we understand why it happened and maintain the illusion that the world is understandable. In fact, we should accept the world is incomprehensible much of the time.’” -Daniel Kahneman

About the Author – Annett Koegler is the co-founder of Santex. Former web developer and now managing the global financial affairs of Santex. Growing up in Communist East Germany, building a company in the United States, Argentina and Peru, and living across multiple continents, her life is far from basic. If you can’t find her behind her desk or on the next airplane, she is running, paddle boarding or exploring some undiscovered parts of this world.